Cada año, el IRS realiza ajustes relacionados con la inflación a más de 60 disposiciones tributarias para mantener los tramos impositivos, las deducciones y otros datos de impuestos sobre la renta en consonancia con los cambios relacionados con el costo de vida. En promedio, los ajustes para el año fiscal 2025, incluyendo los tramos impositivos federales sobre la renta (para quienes presenten sus declaraciones en 2026), aumentaron aproximadamente un 2,8 %.

Recientemente, la aprobación en julio de 2025 de un paquete legislativo integral, conocido como la "Ley de un Proyecto de Ley Grande y Hermoso", establece numerosas leyes tributarias nuevas que entran en vigor de inmediato. Y lo que es más importante, este paquete legislativo hace permanentes aspectos de las leyes que expiraban a finales de 2025.

Estos ajustes podrían afectar sus estrategias de planificación fiscal en el futuro. Salvo que se indique lo contrario, los cambios en la nueva ley tributaria entrarán en vigor a partir del año fiscal 2025.

Cambios en la legislación fiscal de 2025 en tramos impositivos, deducciones y créditos en breve

A continuación se presenta un resumen de los cambios clave en el nuevo proyecto de ley tributaria.

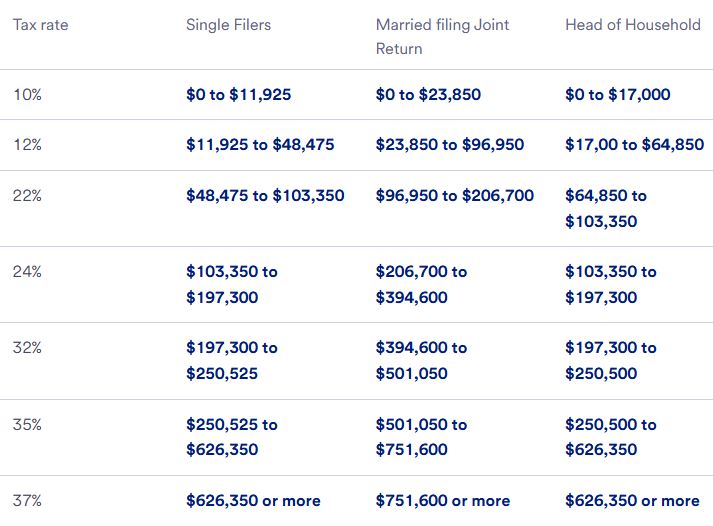

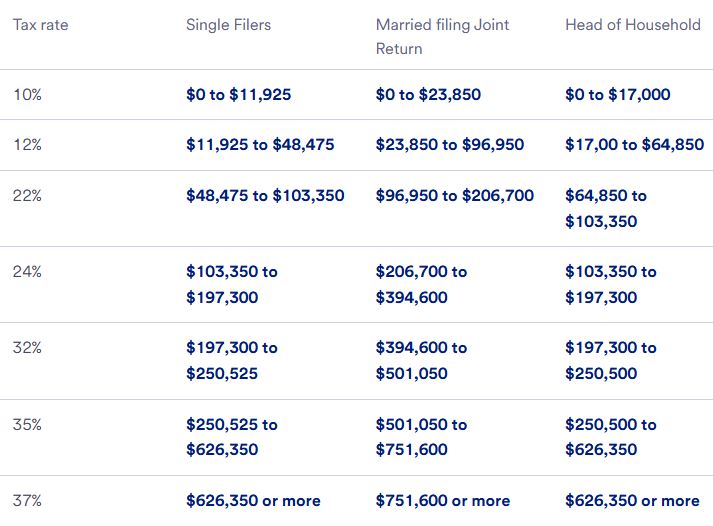

- Los siete tramos impositivos federales (10%, 12%, 22%, 24%, 32%, 35%, 37%) ahora son permanentes.

- Aumentan las deducciones estándar, además de una nueva deducción “adicional” para adultos mayores.

- Se reducen los umbrales mínimos alternativos de exención de impuestos para su eliminación gradual.

- El crédito tributario por hijo aumenta a $2,200 por cada hijo calificado.

- El límite de deducción SALT aumenta temporalmente, con reducciones graduales basadas en los ingresos.

tramos impositivos de 2025

Para el año fiscal 2025, las siete tasas impositivas federales establecidas en la TCJA ahora son permanentes: 10%, 12%, 22%, 24%, 32%, 35% y 37%.

Un umbral de ingresos clave a tener en cuenta para quienes presentan una declaración con ingresos altos es de $197,300 para contribuyentes solteros y $394,600 para parejas casadas que presentan una declaración conjunta. Estos son los umbrales respectivos para ascender del tramo de la tasa impositiva del 24% al tramo de la tasa más alta del 32%. La tasa marginal máxima del 37% se aplicará a los contribuyentes solteros con ingresos tributables de $626,350 y, para las parejas casadas que presentan una declaración conjunta, a los ingresos tributables superiores a $751,600.

Deducción estándar de 2025 y nueva deducción "adicional"

La deducción estándar representa la cantidad de ingresos que puede excluir de impuestos antes de que comiencen a aplicarse las tasas impositivas mencionadas. La deducción estándar de 2025 ha aumentado tras la nueva legislación.

Además, el monto de deducción estándar para una persona que pueda ser reclamada como dependiente por otro contribuyente no puede exceder el mayor de $1,350 o la suma de $450 y el ingreso laboral de la persona.

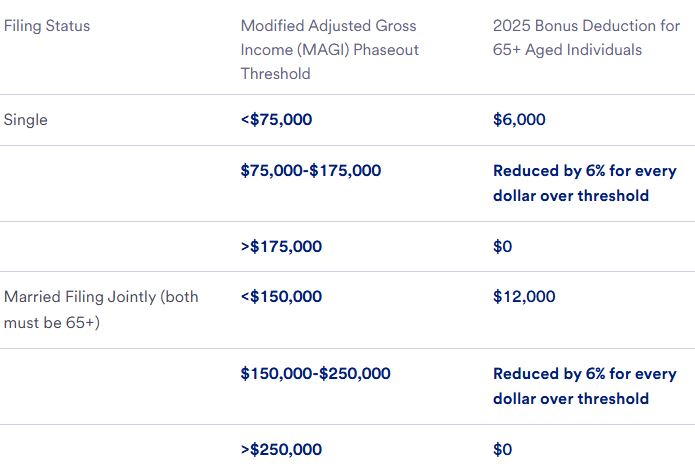

Se agregó una nueva deducción “adicional” para adultos mayores como parte del nuevo paquete tributario, a partir del año fiscal 2025 y vigente hasta 2028.

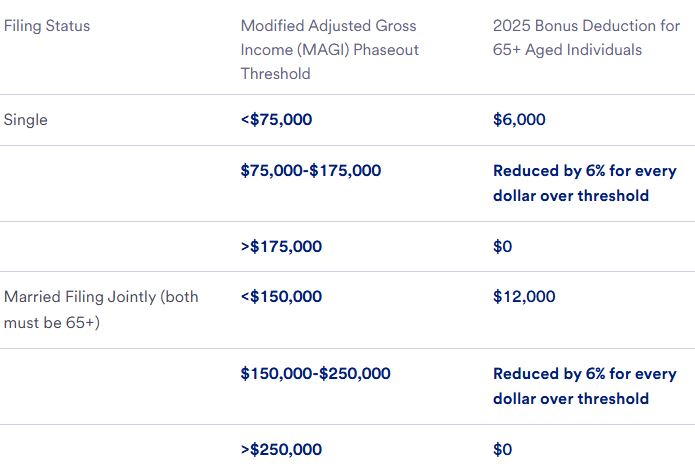

Para 2025, la deducción estándar total más la bonificación para las personas de 65 años o más es de $21,750 para una persona soltera y de $43,500 para una pareja casada que presenta una declaración conjunta. Sin embargo, se aplican límites de ingresos. Solo las personas que presentan una declaración soltera con un ingreso bruto ajustado modificado (MAGI) de $75,000 o menos, o las parejas casadas con un MAGI de $150,000 o menos, pueden solicitar la deducción completa. Esta se elimina gradualmente para quienes tienen ingresos superiores a dichos límites.

SUSCRÍBETE A NUESTRO BOLETÍN

SUSCRÍBETE A NUESTRO BOLETÍN